Looking at the precious metals, gold is one of the most valuable and constant materials known to mankind. Generally for investors who wish to invest in order to be guaranteed the future, gold is the common asset they would purchase. So this ‘buy Australian gold’ guide will be aimed at explaining what and why to buy gold coins efficiently in Australia and other parts of the world. We would also like to inform you whether you are interested in purchasing gold coins online or searching the information about reliable gold coin companies, we are able to satisfy your needs.

Why Invest in Australian Gold?

Australia is among the largest gold producers globally, and therefore is a rich source of gold of the finest quality. People have been using gold as a standard for purchasing other goods and services for centuries. Once you buy Australian gold, you are investing in a product with a tested worth. Some of Australia’s popular gold coins include the kangaroo gold coins and lunar series gold coins and they all come with assurances of their purity from the Perth Mint.

Advantages of Gold Investment in Australia

1. Stability and Security: Gold is one of the oldest types of the monetary system known to mankind for thousands of years. However, gold currency does not depreciate quickly like the paper currency since it is a more stable currency particularly during economic crises.

2. Liquidity: Gold is highly liquid because it is owed and is readily saleable. You can also trade your gold investments easily and get good prices for your gold.

3. Diversification: Investing in gold is helpful to an investor as it offers a way of reducing risk and results in limited loss since gold is a separate asset from all other investments.

4. Hedge Against Inflation: Gold generally is a better bet than most other investment goods during inflationary times.

How to Buy Gold Coins Online?

Online purchasing of gold coins is fast and safe for any investor who wants to invest in gold. Here’s a step-by-step guide to help you get started:Here’s a step-by-step guide to help you get started:

1. Choose a Reputable Gold Coin Company: Choose the research companies that have a good reputation for their honesty and customer support. When it comes to buy Gold Coins online, check out what people have to say about it, particularly other investors.

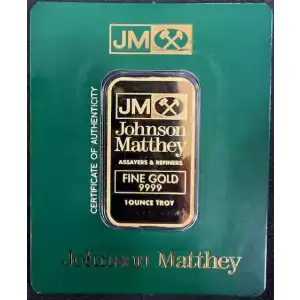

2. Verify Purity and Weight: Where possible, the gold coins can be bought ‘naked’ without any other covers, which actually check that the gold coins you are purchasing are purely of high purity normally, 99. 99 % and accurately weighed.

3. Compare Prices: Dealers can have different prices for the same item. It is useful to cross-check the amount of money these companies offer for business to be sure that you are not being charged grossly high.

4. Shipping and Insurance: Check that you receive the gold coin directly from the gold coin company and they have secure methods of shipment and insurance of the products. This helps in the protection of the investment especially when transporting it.

Tips for First-Time Gold Investors

Managing the gold whenever one is investing in gold for the first time may be very lucrative. Here are some tips to help you get started:Here are some tips to help you get started:

1. Research the Market

- Be aware of gold and its current price in the market.

- Knowing special variables that might have an impact on the gold prices, when analyzing the situation, you should take into account geopolitical factors, inflation rates and rates of other currencies.

2. Determine Your Investment Goals

- Do you need a product for long term investment, for inflationary value of money or for quick return?

- Gold investment will depend on your goals, that is what type of gold investment is best for you.

3. Consider the Costs

- Understand transactional costs for gold, costs of obtaining physical gold and warehousing costs and trading costs based on ETFs and stocks.

- Stack these costs on one or the other of the investment options in front of you.

4. Diversify Your Portfolio

- Do not invest heavily in gold in order not to be affected if its value dramatically drops. This is because diversification is another strategy that can be used to tackle the issue of risk.

- Gold should be looked at as another investment instrument that belongs to the group of stocks, bonds, and others.

5. Understand Tax Implications

- The regime of taxation can also vary depending on the kind of gold investment in question.

- Check the tax consequences of your desired investment so that you do not end up on the receiving end.

6. Seek Professional Advice

- If this is the case, you may need to consult a financial expert or a reputable gold coin company that would have prior knowledge about gold investments.

Conclusion

Purchasing gold is still one of the most effective ways of preserving value and ensuring the future’s financial security. In this case therefore, by deciding to buy Australian gold, one is purchasing gold from one of the most reliable sources.

So, if you will be buying gold coins from Camino Coin Company, or a local store that deals in gold coins and other products, make sure that you are wise while making your purchases. It also can be stated that gold investment is characterized by stability and liquidity, as well as flexibility and safety that allows gold investment Australia to be considered as a diversification, inflation protection tool. Begin your path now and prevent your fiscal wealth from being susceptible to gold.